CLOSING AND INVENTORY

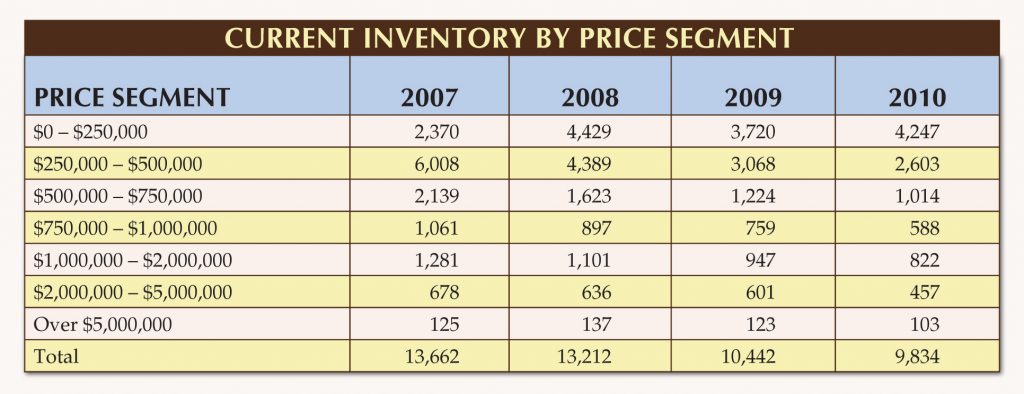

Closed sales units for the third quarter remained strong despite a slight downturn from third quarter 2009. News of the oil spill during July, August and September was the primary factor in causing a slow down in what had been a robust market during the first two quarters. Properties priced below $250,000 comprised 65% of all units closed in the third quarter, and continued to be the most active segment. Inventory in the category is up 14% over Q3 2009 and only slightly below third quarter 2008.

Closed sales above $1,000,000 continued to strengthen, posting an 8.5% increase over Q3 2009. This represents the strongest third quarter for this segment since 2007. Overall, available supply of units continued to decline with supply at the end of the third quarter down 6% from Q3 2009 and 26% from the same period 2008.

NEW LISTINGS AND PENDED SALES

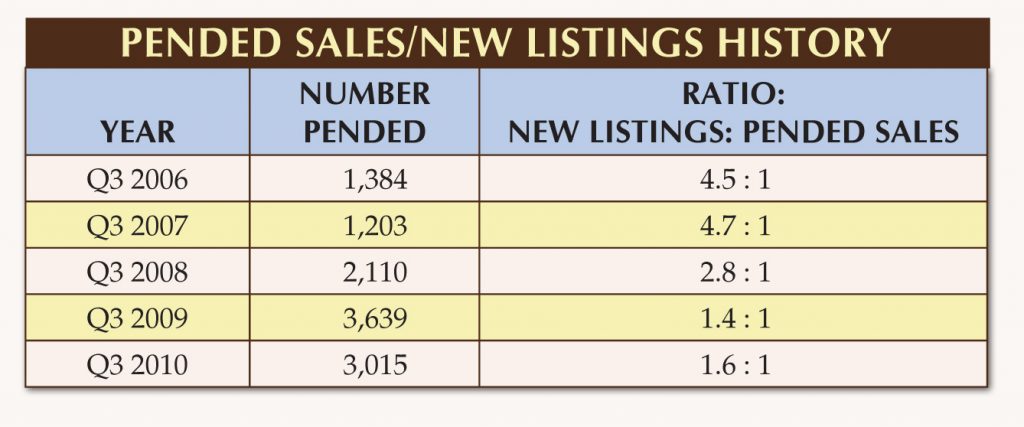

The number of properties placed on the market in the third quarter continued to decline and posted the lowest number for the quarter since 2005. The price category showing the largest decrease in the number of new listings during Q3 2010 vs. Q3 2009 is the $500,000 – $750,000 segment, with a 21% decrease. This is followed by the $750,000 – $1,000,000 category which posted a 17% decrease.

Pended sales remained strong in the third quarter, posting the second highest number of units for any third quarter during the past 11 years. The ratio of closed sales to new listings remained relatively consistent with third quarter 2009 with one pended sale for every 1.6 new listings recorded.

SUMMARY

Inventories in all price ranges, with the exception of properties priced under $250,000, continued to decline. Comparison to the third quarter 2009 shows the largest decreases occurred in condominiums priced between $750,000 and $1,000,000, where the supply declined by 27%. This was followed by condominiums in the $2,000,000 – $5,000,000 range, where the supply diminished by 25%.

Current supply is at its lowest level for the third quarter since John R. Wood Realtors began tracking inventory levels in 2007. Based on absorption rates over the past 12 months, there is slightly less than a twelve month supply, generally considered a well balanced market. Ten of 23 key neighborhoods which the company tracks in Naples, Bonita Springs and Estero now have a balanced supply of single family homes with one year or less of available product.

Average and median sales prices have both shown slight increases in the third quarter, indicative of increased activity in the higher price ranges. Properties priced above $1,000,000 have now posted increases in the number of closed sales for the past four quarters, indicating that a recovery is underway in that segment.

Real estate prices and mortgage rates remain at historical lows, offering great purchase opportunities. As more neighborhoods achieve a balance of supply and demand, we will closely monitor the impact this may have on prices.

This report is intended to give the reader a macro-view of the current market in the combined Naples, Bonita Springs, Estero area. Buyers or Sellers who have interest in a particular area or property should consult with Dustin Beard for up-to-date information on those areas.