CLOSINGS AND INVENTORY

Closed sales units for the third quarter increased slightly over third quarter 2010, with 2,150 closings compared to 2,109 for the prior year. Third quarter closed sales have only exceeded 2,000 units in five of the past 12 years. Two of those were the peak years of 2004 and 2005, and the remaining three occurred in 2009, 2010 and 2011.

Closed sales above $2,000,000 remained strong and posted a 26% increase over third quarter 2010.

Inventory is down in every price segment in both condominiums and single family homes, with the exception of condominiums priced above $5,000,000, which is level with Q3, 2010. The largest decreases occurred in condominiums priced between $2,000,000 and $5,000,000, which decreased by 27% and single family homes priced above $5,000,000, which posted a 24% decline.

NEW LISTINGS AND PENDED SALES

The number of properties placed in inventory in the third quarter continued to decline when compared with the same period in prior years. In fact, it was at its lowest level since Q3, 2004.

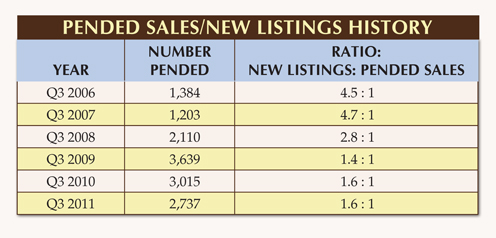

Pended sales remained strong, and third quarter 2011 posted the fourth highest number on record for the quarter. With one pended sale for every 1.6 properties placed on the market, this ratio remains very healthy, and up significantly from 2007 levels when this indicator showed only one sale for each approximately five new listings.

SUMMARY

Available inventory is at its lowest level since John R. Wood Realtors began tracking inventory levels in 2007. Third quarter 2011 posted a 24% decline over Q3 2010. When compared to third quarter 2007, the number of units offered for sale has declined by 45%. It is significant that the segment priced below $250,000 declined by 34% since the same period 2010, and now comprises 38% of total inventory – down from 43% a year ago. Diminishing supplies in this entry-level category could be a factor in driving prices in the future.

Average and median sales prices remain approximately constant with the same period 2010, and at historically low levels. In fact, average sales price is consistent with 2001 levels, providing yet another indicator that it is a great time to buy!

Diminishing supplies in all price ranges, historically low prices and mortgage rates, and one of the best locations in the world, point to an active season in the southwest Florida real estate market. The unprecedented market dynamics which currently exist provide astute buyers with a once-in-a-lifetime opportunity, which will probably not be repeated in the foreseeable future.

This report is intended to give the reader a macro-view of the market in the combined Naples, Bonita Springs, Estero area. Buyers or Sellers who have an interest in a particular area or property should consult with Dustin for specific information on those areas or properties.